Managing payroll can be one of the most time-consuming and complex tasks for any business owner. However, with QuickBooks Online 2024, this process becomes incredibly straightforward and efficient. In this blog, we’ll discuss how to set up and run payroll using QuickBooks Online, as well as the various features it offers to help you manage payroll and payroll taxes effectively.

What QuickBooks Online Payroll Offers

QuickBooks Online Payroll provides comprehensive solutions for businesses of all sizes. Here are some key features and benefits:

- Automated Payroll Processing:

- Automatically calculates paychecks, withholdings, and deductions.

- Offers direct deposit options, allowing employees to receive their pay quickly and securely.

- Tax Filing and Payments:

- Automatically calculates, files, and pays federal and state payroll taxes.

- Ensures compliance with up-to-date tax laws, reducing the risk of errors and penalties.

- Employee Self-Service:

- Employees can access their pay stubs, W-2 forms, and personal information online.

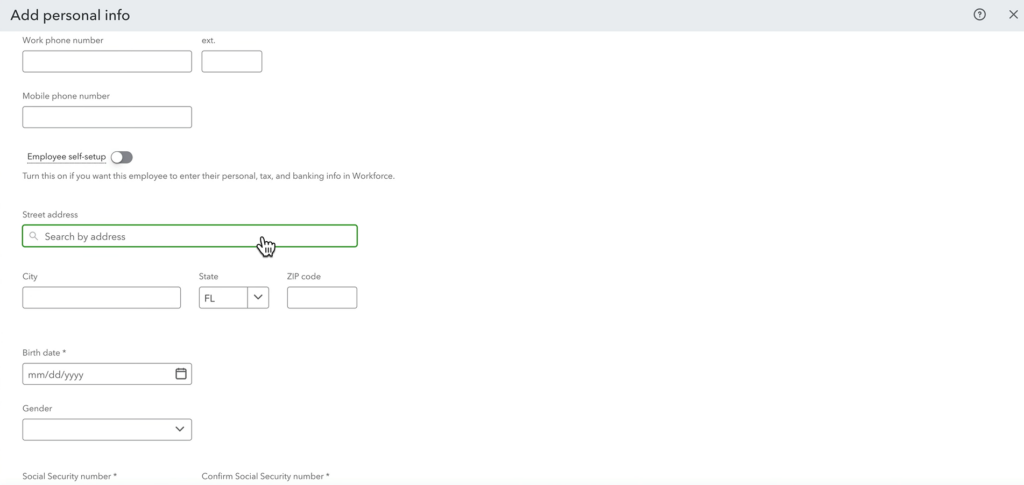

- Self-setup for employees to enter their own details, saving you time and reducing data entry errors.

- Detailed Payroll Reports:

- Provides a variety of reports, such as payroll summaries, tax liability reports, and time activity reports.

- Customizable and exportable to Excel or PDF for easy sharing and analysis.

- Integration with QuickBooks Time:

- Tracks employee hours and integrates seamlessly with payroll.

- Allows for project and job costing, giving you insights into labor costs associated with specific projects.

Getting Started with QuickBooks Online Payroll

Enabling Payroll Services

Before diving into payroll management, you need to enable payroll in QuickBooks Online. Here’s how:

Access Subscriptions and Billing:

- Click on the gear menu in the top right corner.

- Select “Subscriptions and Billing” to view all the services attached to your QuickBooks account.

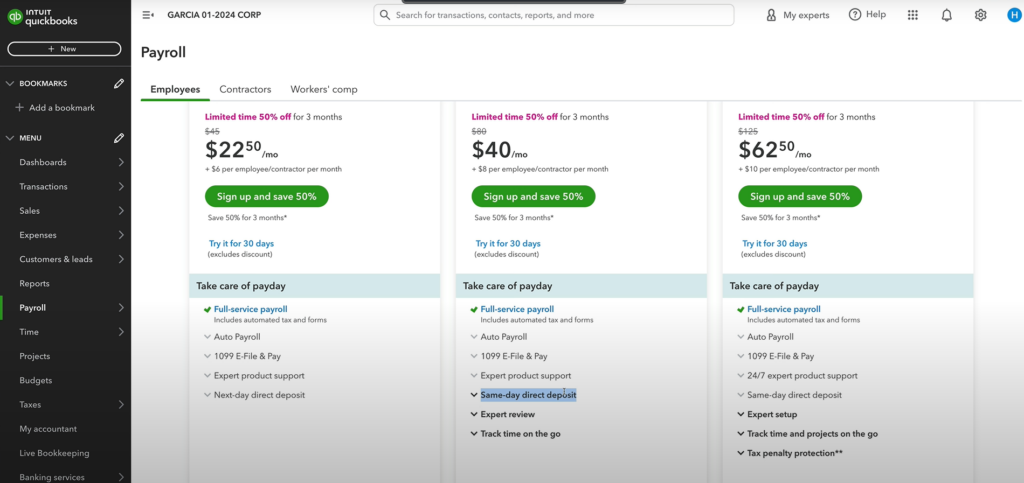

Choose Your Payroll Service:

- If payroll is not yet enabled, you’ll see an option to “Learn More” about payroll services.

- QuickBooks offers three payroll plans: Core, Premium, and Elite. Each has its features and pricing, so choose the one that best fits your business needs.

Pro Tip: Instead of opting for the standard 50% off for three months, email the provided contact in the description to get 30% off for 12 months, offering greater savings over the year.

Setting Up Payroll

- Subscription Process:

- Select the payroll plan (Core, Premium, or Elite) and follow the prompts to start your free trial or sign up.

- Initial Payroll Setup:

- Answer questions about whether you’ve paid employees during the current year.

- Specify your first payday and verify your company details.

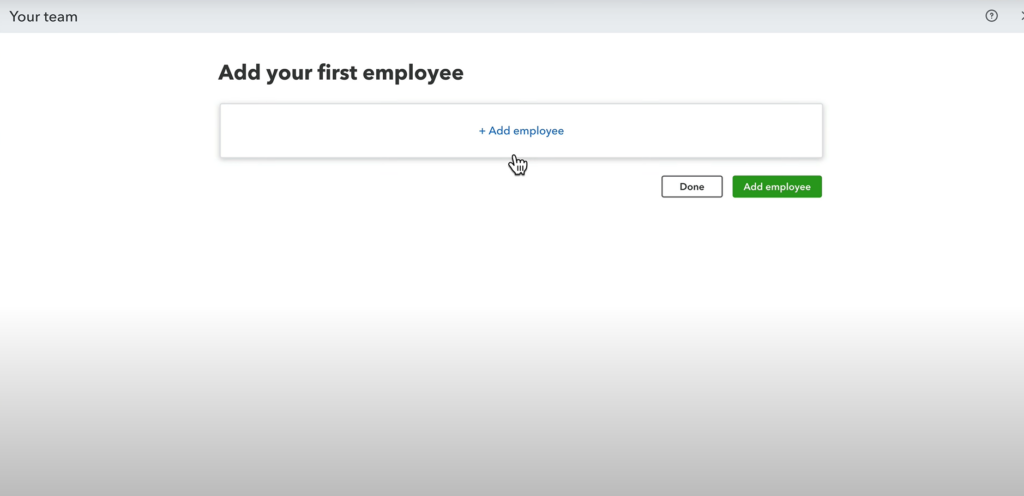

- Add Employees:

- Input employee details such as name, email, hire date, and personal information.

- You can opt for “Employee Self-Setup” where employees enter their own information, or you can manually enter all the details.

Running Payroll

- Employee Information:

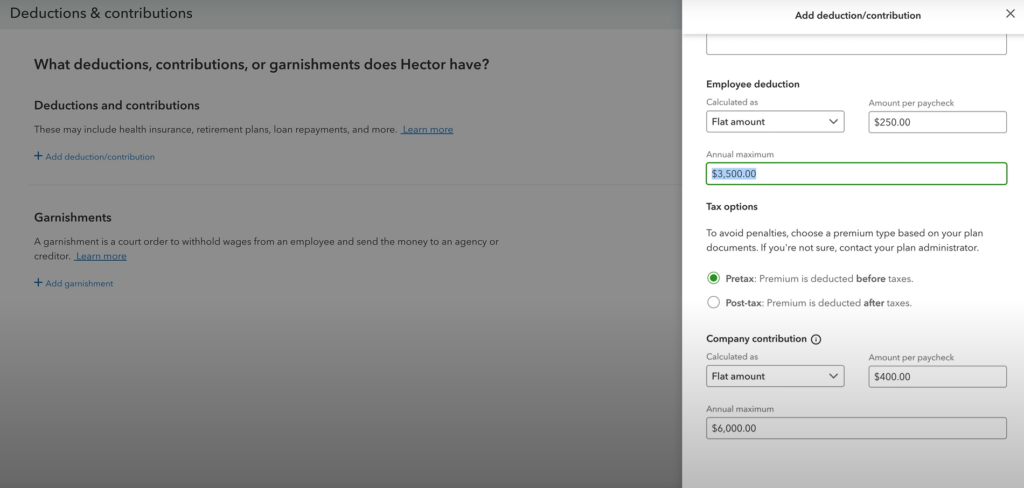

- Enter details like pay type, pay rate, and tax withholding information from the W-4 forms.

- Add any deductions or contributions (e.g., health insurance).

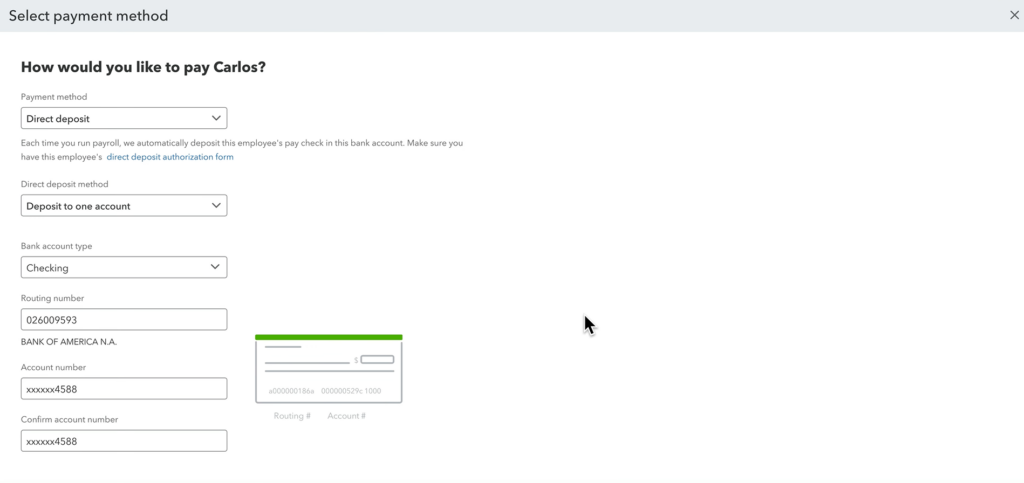

- Payment Methods:

- Choose between direct deposit or paper check.

- For direct deposits, employees will need to provide their bank details.

- Create Paychecks:

- Input the hours worked and any overtime.

- Preview payroll to ensure all details are correct before submitting.

Managing Payroll Taxes

- Automated Tax Forms:

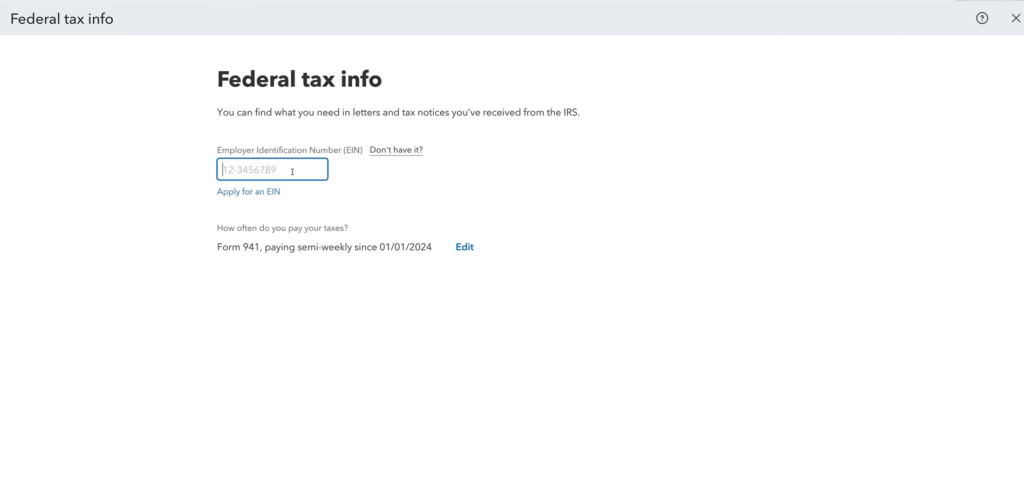

- QuickBooks can handle tax forms automatically, but for this demo, manual setup is shown.

- Input your EIN and state tax information.

- Paying Taxes:

- QuickBooks will calculate your upcoming tax obligations and provide due dates.

- You can pay these taxes through QuickBooks or mark them as paid if you handle it manually.

Payroll Reports

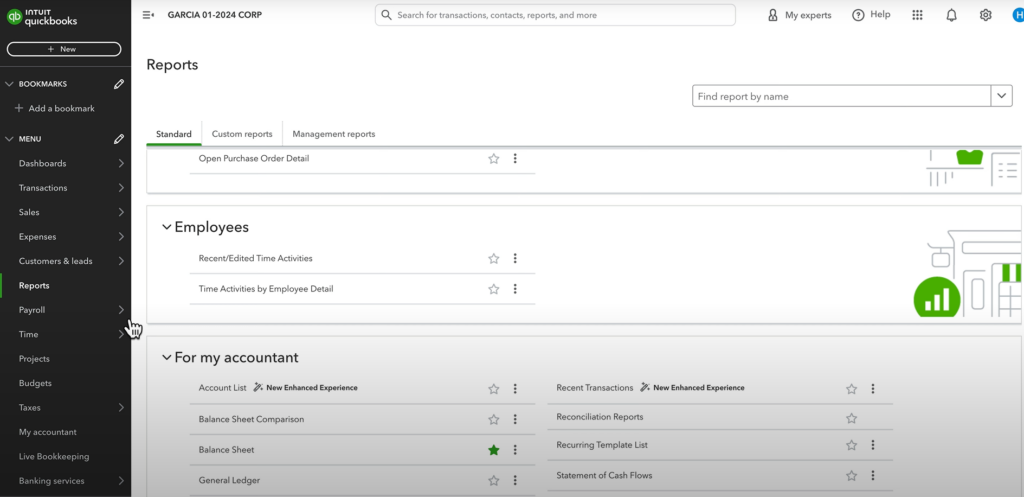

- Accessing Reports:

- Navigate to the “Reports” section in QuickBooks.

- Common reports include Payroll Summary and Payroll Tax Liability.

- Customization and Export:

- Customize reports by location or date range.

- Export reports to Excel or PDF for easy sharing and record-keeping.

Final Thoughts

Running payroll through QuickBooks Online 2024 is straightforward and efficient. Whether you choose Core, Premium, or Elite, each plan offers robust features to ensure your payroll process is smooth and compliant. With automated tax handling and detailed reporting, QuickBooks takes the stress out of payroll management, allowing you to focus on growing your business.

For further details and advanced topics like benefits management, reimbursements, and more, check out additional resources and videos linked in the description. QuickBooks makes payroll easy, so you can say goodbye to the headaches of manual payroll processing.

Feel free to reach out with any questions or for personalized setup assistance. Happy payroll processing!